Collaborative platforms are transforming how investors and entrepreneurs work together. These tools centralize communication, automate data analysis, and streamline workflows, saving time and improving decision-making. Key benefits include:

- Faster due diligence: AI tools reduce analysis time by up to 75%, providing accurate insights in minutes.

- Real-time updates: Dashboards ensure investors stay informed with live financial metrics and progress tracking.

- Improved transparency: Shared platforms promote trust and clear communication between investors and entrepreneurs.

Platforms like ThinkUp simplify startup validation by automating tasks like market research and financial modeling, while enabling direct collaboration through guest access and feedback tools. This approach not only speeds up processes but also strengthens investor-founder relationships, helping both parties achieve better outcomes.

How Collaborative Platforms Support Startup Validation

What Are Collaborative Platforms?

Collaborative platforms serve as centralized digital hubs where investors and entrepreneurs can connect and work together throughout every stage of the fundraising process. Instead of juggling multiple tools, these platforms consolidate everything into one place – handling tasks like idea validation, market research, financial modeling, and pitch preparation. By automating processes such as market analysis and competitive research, they ensure that investors receive clear, standardized, and investor-ready information. This streamlined approach creates an efficient foundation for startup validation, now enhanced by AI tools.

How AI Validates Startup Ideas

AI tools have taken startup validation to the next level by delivering fast and actionable insights. These tools can assess startup ideas in seconds, analyzing key factors like problem–solution fit, market clarity, competitive positioning, revenue model feasibility, and go-to-market strategies – all using real-time data. For example, AI can estimate market size, identify trends, evaluate regulatory challenges, simulate customer feedback from mock launches, and suggest pricing strategies. The results are impressive: 89% validation accuracy, analyses delivered in just 30 seconds, a 67% boost in pitch success rates, and a 43% reduction in time-to-market.

How ThinkUp Supports Startup Validation

ThinkUp is designed to guide entrepreneurs through focused validation sprints, preparing them for investor pitches. It helps founders validate their ideas, conduct market research, create customer personas, and plan finances – all while generating key investor documents. With AI-driven insights, ThinkUp highlights potential weak spots in business models, allowing entrepreneurs to address them before pitching. A real-time dashboard lets investors track progress across various startups, while guest access features make it easy for founders to collaborate with mentors and potential backers. By the end of the process, entrepreneurs have investor-ready pitch decks backed by solid market data and projections, simplifying due diligence and speeding up decision-making.

Setting Up a Workflow for Collaboration with Entrepreneurs

Building a Clear and Efficient Workflow

To simplify the process of working with startups, it’s essential to establish a repeatable workflow. This starts with defining clear intake requirements for every startup entering your pipeline. Instead of juggling multiple tools, platforms like ThinkUp make it easy to create a structured onboarding process. This process gathers critical details upfront – things like business strategy, team structure, market traction, and financial projections. By using conditional logic, ThinkUp transforms traditional data requests into smart digital workflows, ensuring you only ask the questions that matter for each specific startup.

The platform’s standardized profiles help capture key metrics and milestones, making it easier to compare and evaluate startups. This reduces the need for manual screening, speeding up early investment decisions. These profiles also integrate seamlessly with AI-driven validation tools, as discussed earlier, setting the stage for ongoing, real-time monitoring.

Leveraging Real-Time Dashboards

Real-time dashboards act as your central hub, offering live updates on deal stages, startup performance, and relationship activity. ThinkUp’s dashboard allows you to track how startups move through validation sprints, monitor updated assumptions, and review evolving metrics. This up-to-date visibility helps you quickly identify which startups need attention, spot any potential issues, and make data-driven decisions based on current information – not outdated reports. Plus, the dashboards naturally enhance team collaboration by allowing secure guest access.

Encouraging Collaboration with Guest Access

ThinkUp’s guest access feature makes it easy for investors, entrepreneurs, and mentors to collaborate without needing full platform accounts. Available in the Founder Plan ($27.33/month billed annually), this feature enables external stakeholders to engage in the validation process using commenting tools and document review options. Investors can give real-time feedback directly on pitch decks, financial models, and market research. Entrepreneurs can respond quickly, addressing concerns and updating materials right away. This eliminates the back-and-forth of email exchanges and version control headaches. Together, the tools – workflows, dashboards, and guest access – create a seamless, data-driven process that keeps everyone aligned and builds trust.

How AI Collective Is Matching Founders With the Right Investors

sbb-itb-0fe8b1e

Improving Due Diligence with AI-Powered Tools

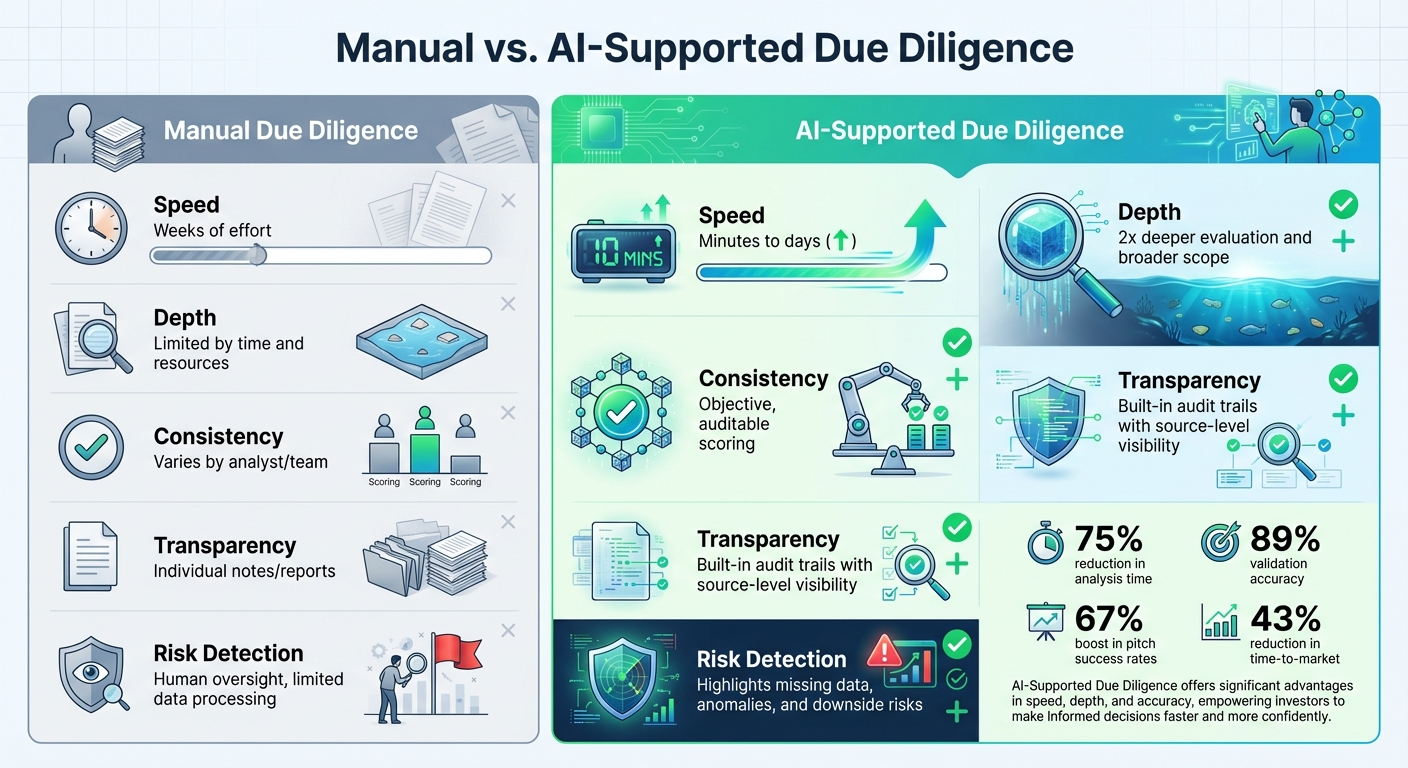

Manual vs AI-Powered Due Diligence Comparison for Investors

AI-Driven Market and Competitor Analysis

AI tools can process vast amounts of data in mere minutes, providing insights that might otherwise go unnoticed. For example, a generative AI agent was able to sift through global databases and local news sources to identify competitors that had been overlooked, revealing untapped margin opportunities. These tools streamline market research and competitive analysis by transforming unstructured data – like thousands of customer reviews – into structured, actionable insights in record time. This isn’t just about working faster; it’s about spotting opportunities and risks that traditional methods might miss entirely.

Quantitative Scoring and Red-Flag Detection

Platforms like ThinkUp use AI to analyze critical documents such as pitch decks, cap tables, profit and loss statements, and forecasts. They highlight risk signals, flag missing data, and identify inconsistent metrics or unrealistic assumptions . The technology dives deep into financial documents, evaluating metrics like EBITDA quality and cash flow sustainability, while also performing downside risk analysis and covenant checks to ensure alignment with underwriting standards . This level of scrutiny enables a more thorough and consistent evaluation compared to traditional methods.

Comparison Table: Manual vs. AI-Supported Due Diligence

| Feature | Manual Due Diligence | AI-Supported Due Diligence |

|---|---|---|

| Speed | Weeks of effort | Minutes to days |

| Depth | Limited by time and resources | 2x deeper evaluation and broader scope |

| Consistency | Varies by analyst/team | Objective, auditable scoring |

| Transparency | Individual notes/reports | Built-in audit trails with source-level visibility |

| Risk Detection | Human oversight, limited data processing | Highlights missing data, anomalies, and downside risks |

The advantages are clear: AI-powered due diligence not only accelerates the process but also enhances accuracy and depth. By maintaining consistent standards across your portfolio, it allows your team to focus on strategic, high-impact tasks instead of getting bogged down in manual data analysis.

Building Stronger Investor-Entrepreneur Partnerships with ThinkUp

Structured Validation Sprints: A Clearer Path to Market Readiness

ThinkUp guides founders through a step-by-step validation sprint that focuses on key areas like customer mapping, market testing, financial planning, and pitch deck development. This organized process provides a transparent view of where a startup stands in its journey. Instead of sifting through scattered documents and incomplete data, you’ll have a clear picture of their progress – whether they’ve identified their target customers, tested demand, or created realistic financial plans. This transparency makes it easier to gauge whether a startup is ready for investment discussions, giving you confidence in identifying ventures that are prepared to move forward. Plus, this structured approach lays the groundwork for effective coaching and ongoing oversight.

Real-Time Collaboration for Better Feedback

ThinkUp’s platform includes tools that let you engage with founders directly on critical aspects of their business. You can leave specific comments on financial assumptions, challenge go-to-market strategies, or suggest tweaks to customer targeting – all within the same workspace where founders are actively building their business. With guest access, you can review progress and offer focused feedback in real-time. This creates a continuous feedback loop that not only strengthens relationships but also helps entrepreneurs fine-tune their strategies before small issues become major roadblocks.

Simplified Portfolio Management and Insights

ThinkUp goes beyond individual feedback by centralizing portfolio management into one easy-to-use dashboard. From this single view, you can track the progress of multiple startups, monitor their milestones, and identify areas where additional support might be needed. The platform’s AI tools also surface trends and potential concerns across your portfolio, helping you spot patterns that deserve your attention. With everything in one place, there’s no need to chase updates through endless emails or spreadsheets – ThinkUp provides a streamlined way to stay on top of your investments while reducing administrative headaches.

Conclusion

Key Takeaways for U.S. Investors

The investment landscape is shifting, and staying ahead now requires tools that streamline collaboration. Centralizing your workflow is no longer just a convenience – it’s a necessity. ThinkUp simplifies this process, bringing everything you need into one workspace. From tracking multiple startups to monitoring their progress and engaging with founders at critical moments, this platform replaces scattered emails and disjointed systems with a unified solution. The result? Smoother due diligence and stronger connections between investors and entrepreneurs.

AI-powered tools are also transforming the way you approach due diligence. What used to take weeks of manual effort can now be done in a fraction of the time. Automated insights help flag risks, validate assumptions, and identify patterns across your portfolio. This not only saves time but also provides data-driven clarity, giving you greater confidence in your decisions compared to traditional methods.

But the real game-changer lies in the relationships you build. Real-time collaboration tools allow you to go beyond being a passive investor. By providing targeted feedback on critical business aspects, you become a strategic partner who actively contributes to a startup’s success. These AI-enhanced insights enable quick, informed decision-making, creating a transparent and ongoing dialogue that strengthens mutual trust and alignment.

For U.S. investors navigating a competitive market – where AI accounted for 37% of venture funding in 2024 – adopting centralized workflows and AI-driven tools is more than a trend. It’s about working smarter, making faster, more informed decisions, and building a portfolio of startups with real growth potential. ThinkUp offers the structure to make this possible, supporting you at every stage, from initial evaluation to long-term portfolio management.

FAQs

How can collaborative platforms strengthen the relationship between investors and entrepreneurs?

Collaborative platforms are transforming how investors and entrepreneurs work together, offering a transparent and shared space for communication and decision-making. By centralizing critical elements like real-time performance metrics, financial updates, and milestone tracking, these platforms cut down on delays and make due diligence more efficient. The result? Both parties stay informed and aligned every step of the way.

For investors, tools such as AI-powered startup validation and shared workspaces simplify evaluations while minimizing bias. Entrepreneurs, on the other hand, benefit from faster feedback and clearer direction, which can lead to quicker funding decisions. This dynamic creates a more focused and results-driven partnership, where both sides are working toward shared goals and measurable outcomes.

How does AI improve startup validation on ThinkUp?

AI is reshaping how startup validation happens on ThinkUp, making the process faster, more precise, and deeply data-driven. By diving into financial records, market trends, product performance, and even founder backgrounds, AI can quickly evaluate a startup’s growth potential. It also spots hidden risks and benchmarks performance against industry standards. What used to take weeks of due diligence can now be done in just a few days.

Beyond speeding things up, AI improves decision-making with predictive analytics that pinpoint startups most aligned with an investor’s objectives. It also brings transparency to the table by linking every insight back to its original data source. This means investors can verify the information themselves, fostering better collaboration with entrepreneurs. The result? Faster decisions, clearer insights, and stronger partnerships built on trust between founders and investors.

How do real-time dashboards help investors make smarter decisions?

Real-time dashboards offer investors a clear, up-to-the-minute snapshot of key performance metrics across their portfolio companies. These tools pull data from multiple sources – like accounting software and market analytics platforms – into a single, visual interface. This makes it easy to monitor crucial metrics such as revenue growth, burn rate, and user acquisition all in one place. With this consolidated view, investors can quickly spot trends, uncover anomalies, or identify potential risks as they arise.

Because the data updates automatically, investors save valuable time that would otherwise be spent on manual reporting. This streamlined approach makes preparing for board meetings or capital calls far more efficient. Dashboards can also be configured to send alerts when specific performance thresholds are crossed, ensuring that any necessary interventions happen promptly. By giving both investors and entrepreneurs access to the same real-time data, these dashboards promote transparency and encourage collaboration, paving the way for smarter decisions and quicker action on growth opportunities.